Introduction

Strengthening supply chain resilience has become an increasingly important task for the global community following recent developments such as the coronavirus pandemic, which arose around the end of 2019, and the Russian invasion of Ukraine in February 2022. For Japan, supply chain issues center on the need to secure stable supplies of strategically important materials including microchips, rare-earth elements, automotive batteries, minerals, and medical supplies. The key to bolstering supply chains, especially in the case of such strategically important materials, lies in logistics. As of 2020, maritime transport accounts for as much as 99.6% of Japan’s exports and imports on a tonnage basis.[i] Thus, developments in maritime shipping are of direct concern to the nation’s economic security.

Since September 2014, China has expanded its maritime influence under a national strategy of becoming a “strong maritime power.” (haiyangqiangguo) As part of this maritime expansion, China has made striking progress in building container shipping networks and in increasing control over overseas ports. Yet, this issue has yet to attract a level of attention commensurate with the scale of its importance. To address the paucity of literature, the present article traces China’s maritime expansion using data related to maritime transport, size of merchant fleets, and marine terminal operations. The article further reveals that China has bolstered its maritime presence amidst the pandemic.

1. Maritime Transport

Even amidst the pandemic, container traffic in Chinese ports continues to increase. According to the China Statistical Yearbook, container traffic among Chinese ports roughly doubled every five years between 1990 and 2010: it reached approximately 483.2 million tons in 1990, 801.6 million tons in 1995, 1.26 billion tons in 2000, 2.93 billion tons in 2005, and 5.48 billion tons in 2010. After 2010, the output continued climbing, albeit at a slower pace, reaching7.85 billion tons in 2015, 8.19 billion tons in 2016, and 8.65 billion tons in 2017.[ii] In 2018, it reached 9.22 billion tons and then dipped slightly to 9.19 billion tons in 2019. In 2020, despite the impact of the coronavirus pandemic, the level recovered to 9.48 billion tons.[iii]

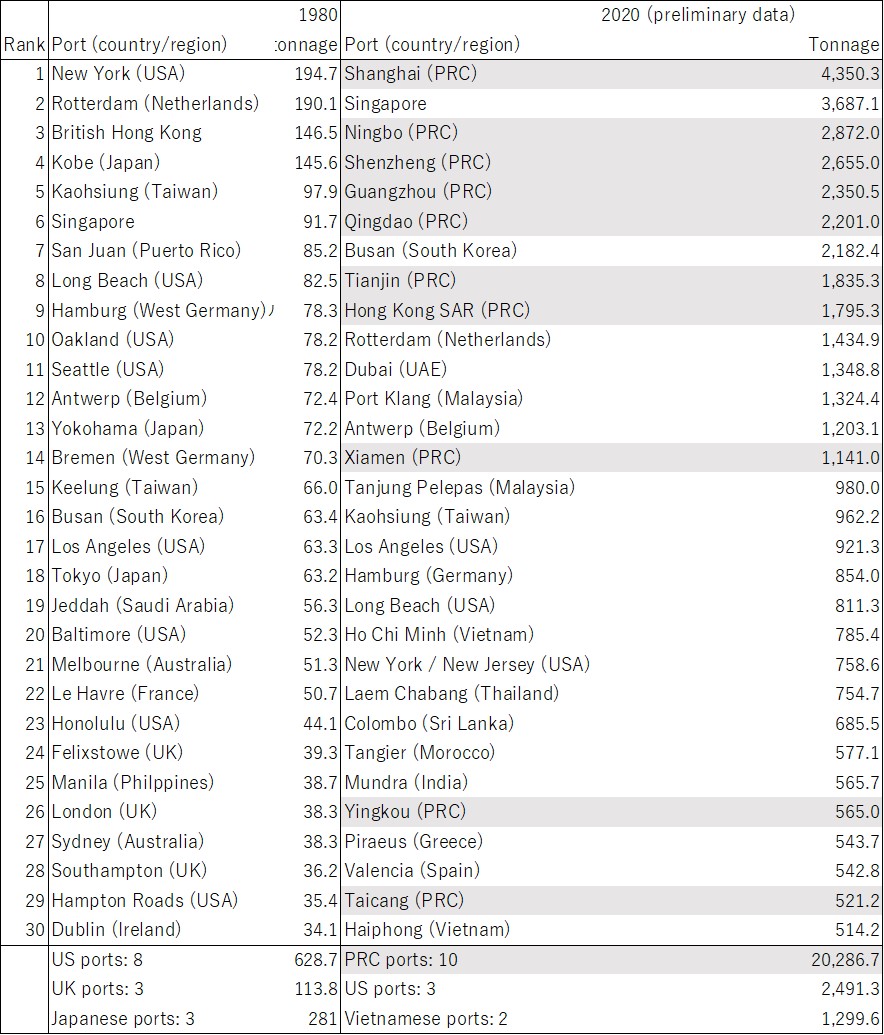

Looking at the number of containers handled by ports in the world, we can see China’s rapid progress. The growth in container traffic becomes clearer once we compare the top 30 busiest ports in 1980 with the same in 2020 (see Table 1). In 1980, eight of the 30 busiest marine terminals were in the USA, while there were none in China. In contrast, in 2020, only three of the top 30 busiest ports were American, while as many as 10 were Chinese ports. Moreover, Chinese ports accounted for seven of the top 10 spots: Shanghai was the busiest port, Ningbo was third, Shenzhen fourth, Guangzhou fifth, Qingdao sixth, Tianjin eighth, and Hong Kong ninth.[iv] Shanghai has continually held the top spot since overtaking Singapore in 2010, and other Chinese ports are steadily growing busier year by year.[v]

Based on data from the Ministry of Land, Infrastructure, Transport and Tourism, and from the Ports & Harbours Association of Japan

2. Size of Merchant Fleets

China is also growing its merchant fleet, as revealed by data on the world’s largest fleets by owner nationalities. In 2020, the world merchant fleet had gross tonnage of 1.43 billion. Of this, Mainland China (excluding Hong Kong) was the seventh largest ship-owning country with 62.0 million gross tons (GT), accounting for 4.3% of the world total. Hong Kong was the fourth largest with 128.9 million GT, accounting for 9.0% of the world figure. When their shipping registries are combined, Mainland China and Hong Kong accounted for 13.3% of world shipping with 190.9 million GT. In comparison, Panama was the world’s largest ship-owning nation with 226.4 million GT (15.8% of the world total), and Liberia came in second at 187.5 million GT (13.1%). Thus, when the Hong Kong Shipping Register is included, Chinese shipping occupies the number 2 spot, exceeding Liberia-registered shipping.[vi]

The China-registered merchant fleet has shown notable growth in recent years. In 2017, Mainland China was the eighth largest in the world with gross tonnage of 48.5 million (3.8% of the world total), denoting that it grew by 27.9% between 2017 and 2020. In the same year, Hong Kong had the fourth largest ship registry with 113.4 million GT (8.8% of world shipping), a percentage increase of 13.7% over the same period.[vii]

Japan, South Korea, and China collectively account for 90% of global merchant shipbuilding, and China’s share in this industry has grown markedly in recent years. In 2000, China’s share was just 5.2%, but it subsequently increased, reaching 13.8% in 2005. In 2010, China overtook South Korea to become the largest merchant shipbuilding nation with a share of 37.8%, exceeding South Korea’s 32.9% share. Since then, China has kept its share in the high thirties and vied with South Korea over the top spot. In 2017, China boasted a share of 36.2% to South Korea’s 34.1%, and has retained the largest share since, reaching 40.0% in 2018, 35.0% in 2019, and 39.9% in 2020.

Japan was the largest commercial shipbuilding nation in 1995 with a 41.2% share. By 2000, the share was down to 37.9%, putting Japan into second place behind South Korea, whose share was 38.6%. In 2005, Japan remained in second place with a 35.0% share to South Korea’s 37.7%. In 2010, Japan fell to third place and remained there over the years that followed, with its share trending in the mid-20s. In 2020, the share was down to 22.2%.[viii]

Alongside the above trends, we can discern a rise in the percentage of world cargo substantively owned by Chinese shipping companies. In January 2020, Greek companies had the largest share with a carrying capacity of 364 million tons deadweight (DWT) and Japanese companies had the second largest share with a 233 million DWT. Mainland China took third place with 228 million DWT and Hong Kong took fifth place with 101 million DWT. Mainland China and Hong Kong’s combined deadweight tonnage was 329 million, close to the Greek level.[ix] For comparison, in September 2017, Japan was in second place with 224 million DWT, Mainland China was in third place with 165 million DWT, and Hong Kong was in sixth place with 94 million DWT.[x] Thus, whereas the tonnage attributable to Japanese shipping companies grew by 4.0% between 2017 and 2020, the same for Hong Kong companies grew by 17.0% while it grew by 38.1% for Mainland Chinese companies. Chinese shipping looks set to continue increasing in the years ahead.

3. Marine Terminal Operations

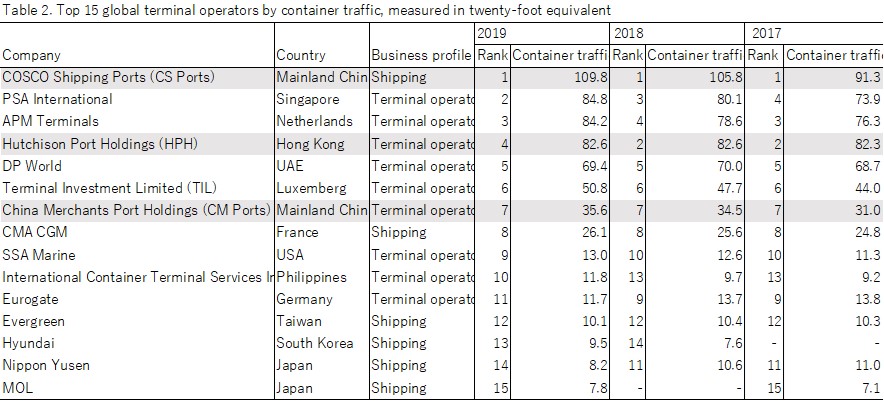

Chinese companies are also making inroads into marine terminal operations. The operation of ports around the world is an oligopolistic market dominated by a handful of large, multinational port companies known as global terminal operators (GTOs). The five main GTOs account for an overwhelming amount of container traffic (see Table 2).[xi] The GTO that boasts the highest volume of container traffic is COSCO Shipping Ports (CP Ports), which is part of the China Ocean Shipping Company, a major state-owned shipping company in China. CP Ports has held the top spot since 2016, having been in fourth place in 2015.[xii]

Another one of the top five is Hutchison Port Holdings (HPH), a dedicated terminal operator based in Hong Kong. Then there is China Merchants Port Holdings (CM Ports), a terminal operator that operates under the umbrella of the China Merchants Group Limited, a conglomerate that deals in transportation, finance, and real-estate in China. CM Ports came in at seventh place in 2019, but its container volume has grown year by year. As these data illustrate, Chinese companies are increasing their presence in port management.

Based on data from Nippon Yusen Kaisha, Fact Book I 2021, May 2021

In 2018, the fifteenth spot was taken by German company HHLA with 74 thousand TEU. In 2017, the fourteenth spot was taken by Hong Kong company OOCL with 78 thousand TEU.

Conclusion

In recent years, China has made its presence increasingly felt in maritime shipping in terms of container traffic, marine vessels, and marine terminal operations, all of which play a vital role in supply chain management. This maritime expansion has continued even amidst the coronavirus pandemic. For most states, maritime transport constitutes the linchpin of logistics, and ports and harbors constitute strategic infrastructure. A rising share attributable to a particular country or company does not in itself present a direct security threat. Given that the maritime shipping industry can be used as a tool for economic statecraft, however, it is necessary to closely monitor developments in this industry from a strategic perspective. It is also important to build an international consensus against the misuse of oceans as such a tool.